How much is renters Insurance in va: Whether you’re in Virginia for school, employment, recreation, or anything else, you should consider getting renters insurance. We’ll go over the fundamentals of renters insurance coverage, as well as some of the most interesting cities and hidden gems to visit in the Mother of States—and beyond.

While renters insurance is not required by law in Virginia, certain landlords may require it if you live in their building. It’s generally a good idea to obtain some type of coverage because your landlord’s insurance is not responsible for any damage to your personal belongings. In the event of a fire, accident, or burglary, you will be liable for replacing your items.

How Much is renters Insurance in VA.

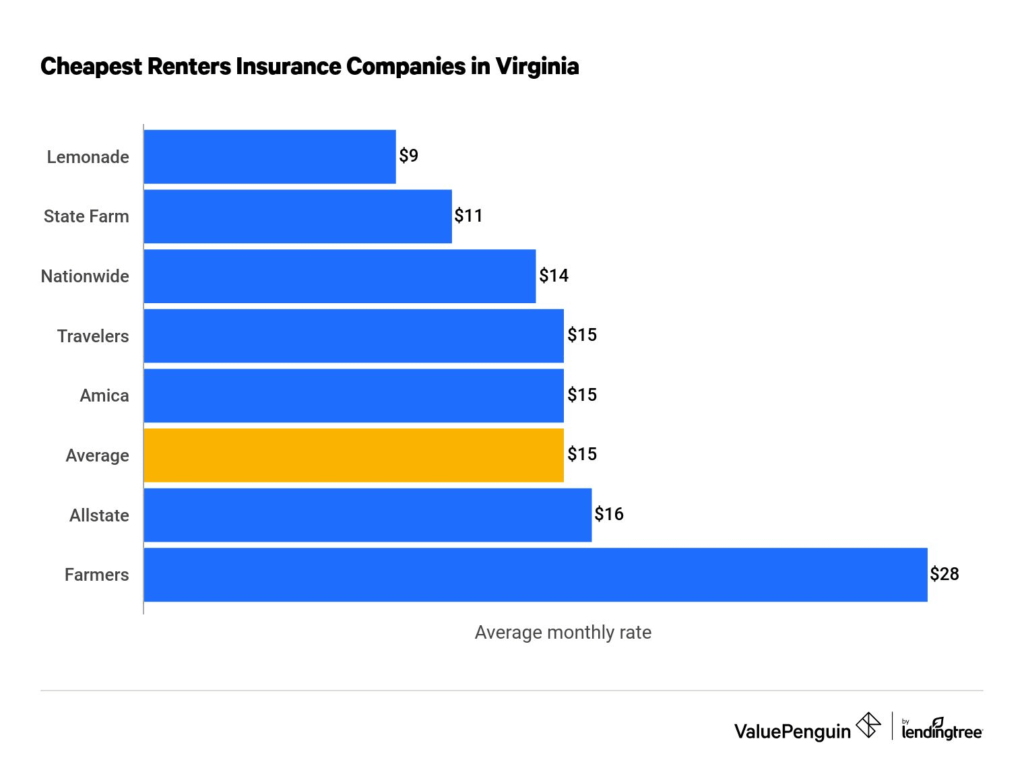

In accordance with ValuePenguin.com, the average cost of renters insurance in Virginia is $15 per month in 2024. The typical nationwide rate for Lemonade Renters in the United States is $14/month as of January 1, 2024.

Because many factors might influence your unique premium, filling out an online quote is the simplest approach to discover your exact price.

What does your renters insurance cover in VA.

Renters insurance is a terrific idea in theory, but it’s important to understand its practical benefits. Let us break down the components of your insurance and your coverage alternatives.

Personal Property:

‘Personal property coverage ensures that your stuff, your personal items, are secured whether you’re resting at home or traveling across Europe. So, if your living room furniture is wrecked as a result of water damage from a broken pipe, or your phone is stolen while you’re in Berlin, your renters insurance coverage will protect you.

Loss of Use:

What happens if calamity strikes? If you are unable to stay in your home due to covered losses (such as a fire or a windstorm), your ‘loss of use’ coverage reimburses you for temporary accommodation and additional living expenses such as food, laundry, hotel parking, and more.

Liability coverage

If someone is harmed in your flat, or someone on your policy damages someone else’s property or belongings, your insurance provider should cover legal fees and property damage.

Medical Protection

If your guests are wounded at your home, or if you accidentally damage someone outside of your home, your insurer will cover the medical expenses. It is important to note that your renters insurance coverage does not cover medical expenses if you or someone you live with is injured—only non-residents and guests are covered.

What is the best kind of coverage to purchase?

There is no simple answer to that issue, and it depends on how much material you need to cover and how much it is worth. As we discussed earlier, your policy has a few major categories: Contents (your belongings); Loss of Use (temporary living expenses); and Personal Liability and Medical Bills.

When you sign up for a Lemonade policy, you can specify the coverage limits for these categories, and you can adjust them at any time.

- Lower coverage limits may save on premiums but may result in insufficient coverage for claims.

- Deductible must be calculated considering property and lifestyle.

- Apply for a renters insurance quote to understand insurance options.

- ‘Extra Coverage’ for valuables like engagement rings, cameras, musical instruments, or artworks can be added.

The most costly states for renters insurance.

When renters insurance companies compute your quote, they will consider your location and risk. If you reside in a location prone to severe storms, you may see higher prices. This is one of the reasons why Louisiana has the highest hurricane and tornado rates.

Here are the five most costly states for renters insurance with a $15,000 personal property limit.

| STATE | ANNUAL COST | MONTHLY COST |

| Louisiana | $294 | $25 |

| Mississippi | $221 | $18 |

| Arkansas | $208 | $17 |

| Georgia | $187 | $16 |

| Connecticut | $185 | $15 |

Cheap Renters Insurance Companies

For many people, one of the most essential considerations when selecting a renters insurance policy is cost. Based on average prices, Allstate provides the cheapest renters insurance in Virginia. On average, an Allstate policy costs $8 per month or $95 per year. Metlife is the second most economical alternative, with plans averaging $116 per year, or $10 per month.

These figures are based on MoneyGeek’s research of a wide range of ZIP codes in Virginia for a policy with $20,000 in personal property coverage, $100,000 in liability coverage, and a $500 deductible.

| Company | Amount per year |

| Allstate | $95 |

| MetLife | $116 |

| State Farm | $139 |

| Farmers | $158 |

How Much is renters Insurance in VA?

ValuePenguin.com reports Virginia renters insurance average monthly cost $15, while nationwide Lemonade Renters rate is $14. Online quotes are recommended for accurate pricing.

What is the best kind of coverage to purchase?

Coverage limits for Lemonade policies vary based on content, loss of use, and personal liability. Deductibles must be calculated based on property and lifestyle.

What does your renters insurance cover in VA?

Renters insurance provides coverage for personal property, loss of use, liability, and medical protection. It secures personal items, reimburses for temporary accommodation and living expenses, covers legal fees and property damage, and covers medical expenses for non-residents and guests.