INTRODUCTION:

Progressive Boat Insurance is a product from Pioneer Insurance, one of the most well-known insurance businesses on the market. This kind of insurance is preferred by sailors since it covers an extensive array of boat models. In this piece, we will get into the specifics of Progressive Boat Insurance, including its characteristics, eligibility requirements, and much more.

What is Progressive Boat insurance?

A broad variety of boats, include sailing vessels, powerboats, fishing boats, personal watercraft, and float boats, are covered by Progressive Boat Insurance. Among this insurance’s principal characteristics are:

- Offers liability with limits up to $1,000,000, covering property damage, bodily injury, and environmental damage.

- Provides “market value” and “agreed value” boat protection options.

- Provides coverage options for mechanical failure, fuel leak, fishing equipment, and water sports injuries.

- Cost-effective with minimum coverage rates as low as $100 annually.

- Waiver of typical requirements like marine surveys, navigation plans, and travel restrictions.

- Automatic coverage for all lakes, rivers, and ocean waters within 75 miles of the coast.

Eligibility Criteria:

The following are the prerequisites for qualifying for Progressive Boat Insurance:

- Coverage for boats over $500,000 for 0-10 years old, over $350,000 for 11-20 years, and over $75,000 for over 20 years old.

- Insures racing use on most sailboats, but excludes sailboats over fifty feet, priced over $50000, wooden or steel hulls, and non-compliant U.S. Coast Guard requirements.

- Eligibility excludes houseboats and primary residences.

- Handmade boats without hull identification number are not covered.

About Progressive Boat Insurance Company

Founded:1937

Headquarters: Mayfield, Ohio

In the 1950s, Progressive, a pioneering insurance provider, rose to renown by its advertisement of high-risk driver auto coverage and online policy sales. It will issue around $52.3 billion in premiums in 2023, holding 6.01% of the US insurance market currently.

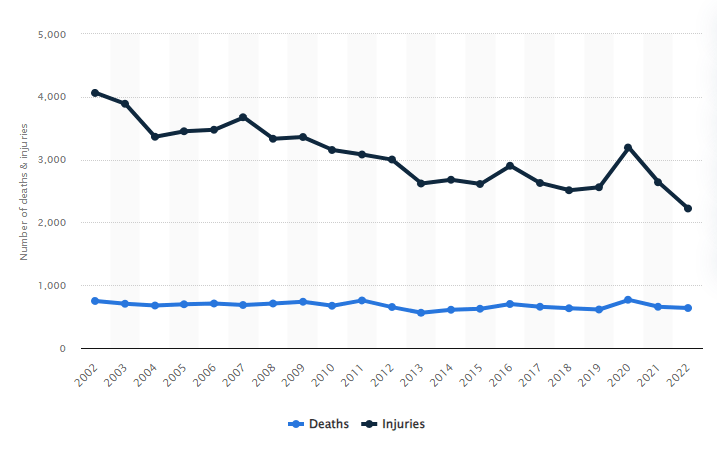

Boating Accident Statistics

Standard Boat Standard Coverage:

- Bodily injury liability: Covers associated expenses, lost income, and medical bills of other parties in boating accidents.

- Property damage liability: Pays for repairs to other people’s boats and personal belongings.

- Collision insurance: Covers repairs to your boat in covered accidents.

- Comprehensive coverage: Provides protection against weather-related, non-accidental physical damage.

- Medical payments: Pays for any party’s medical costs from a covered accident.

- Uninsured boater coverage: Covers property and injury expenses if an at-fault boater lacks sufficient coverage.

Reviews about Progressive Boat Insurance:

Customer Testimonials for Marine Insurance

- There aren’t many reviews for marine insurance, but you can tell a lot about a company’s customer service from the way it handles claims and clients.

- On the BBB website, Progressive is rated an average of 1.1 out of 5.0 stars.

- Good feedback emphasizes the prompt and courteous customer service and effective claims procedure.

- The team tried to respond to poor reviews but got no response.

- poor reviews frequently center on communication problems, frequently with adjusters.

What are the Eligibility Criteria for applying progressive boat insurance?

The policy covers boats over $500,000 for 0-10 years, $350,000 for 11-20 years, and $75,000 for over 20 years. It covers racing use on most sailboats but excludes sailboats over fifty feet, priced over $50000, wooden or steel hulls, non-compliant U.S. Coast Guard requirements, houseboats, primary residences, and handmade boats without hull identification numbers.

What are the Standard Coverage rate for Progressive Boat insurance?

Boating accident insurance covers expenses, lost income, and medical bills. It covers property damage liability, collision insurance, comprehensive coverage, medical payments, and uninsured boater coverage for at-fault boaters.

What is Progressive Boat Insurance ?

The policy offers liability coverage for property, bodily, and environmental damage, with options for mechanical failure, fuel leak, fishing equipment, and water sports injuries, with cost-effective minimum rates as low as $100 annually.